Fort Myers, Florida Universal Life Insurance

What Is Universal Life (UL) Insurance?

Universal life (UL) insurance is a type of permanent life insurance that, like other permanent insurance, has a cash value element and offers lifetime coverage as long as you pay your premiums. Unlike whole life insurance, universal life allows you to raise or lower your premiums within certain limits, and it can be cheaper than whole life coverage. However, if your investments underperform or you underpay for too long, it could affect your death benefit or cause your policy to lapse.

- Universal life (UL) insurance is a form of permanent life insurance with an investment savings element plus premiums and a death benefit that are flexible.

- Unlike term life insurance, a UL insurance policy can accumulate cash value.

- The cash value earns an interest rate set by the insurer, and it can change frequently, although there is usually a minimum rate that the policy can earn.

- If the investments underperform, your cash value can go down and your premiums could eventually go up.

- There are no tax implications for policyholders who borrow against the accumulated cash value of their UL policy, although some withdrawals may be taxed.

How Universal Life (UL) Insurance Works

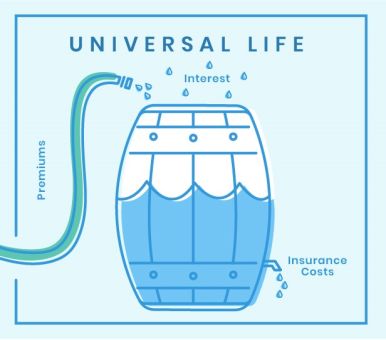

UL insurance provides more flexibility than whole life insurance. Policyholders can adjust their premiums and death benefits. UL insurance premiums consist of two components: a cost of insurance (COI) amount and a saving component, known as the cash value.

As the name implies, the COI is the minimum amount of a premium payment required to keep the policy active. It consists of several items rolled together into one payment. COI includes the charges for mortality, policy administration, and other directly associated expenses to keep the life insurance policy in force. COI will vary by policy based on the policyholder’s age, insurability, and the insured risk amount.

Collected premiums in excess of the cost of UL insurance accumulate within the cash value portion of the policy. Over time, the cost of insurance will increase as the insured ages. However, if sufficient, the accumulated cash value will cover the increases in the COI.

Advantages and Disadvantages of Universal Life Insurance

Pros

- Flexible premiums

- Possible flexible death benefit

- Potential cash value growth

- Allows policy loans

Cons

- Risk of large payment requirements or policy lapse

- Returns are not guaranteed

- Some withdrawals are taxed

- Cash value lost at policyholder’s death

Pros Explained

Flexible Premiums

Unlike whole life insurance policies, which have fixed premiums over the life of the policy, a UL insurance policy generally has flexible premiums—within limits. Policyholders can make payments that are more than the COI. The excess premium is added to the cash value and accumulates interest. Alternatively, if there is enough cash value, policyholders may lower or skip payments without the threat of a policy lapse.

Possible Flexible Death Benefit

Your policy may allow you to increase the size of your death benefit, although that may require a medical exam. You may also be able to lower your death benefit to lower your premiums.

Potential Cash Value Growth

Like all permanent life insurance, a UL insurance policy can accumulate cash value in something like a savings account. The cash value earns interest based on the current market or the policy’s minimum interest rate, whichever is greater. As it accumulates, policyholders may take out a portion of the cash value in the form of partial withdrawals or loans.

Allows Policy Loans

Universal life policyholders may borrow against the accumulated cash value without tax implications. The interest rates on these loans are often lower than rates available for a personal loan, and they don’t require a credit check. However, unpaid loans will reduce the death benefit by the outstanding amount.

Cons Explained

Risk of Large Payment Requirements or Policy Lapse

While the ability to lower your premiums and to make withdrawals in times of need help make universal life a very flexible insurance type, you have to watch your account carefully. If your cash value falls to zero and your premiums don’t cover the cost of insurance, then your policy can lapse.1

Returns Are Not Guaranteed

If interest rates drop, your cash value may not perform well. Unlike whole life, universal life cash value does not earn a guaranteed rate. However, most UL policies come with a minimum rate so that your losses are limited.

Some Withdrawals Are Taxable

When UL policyholders withdraw some of the cash value, it will be taxable. In general, life insurance is taxed on a first in, first out (FIFO) method, meaning that the policy owner will receive their investment in the contract first before receiving any gains in the policy (or being taxed on those gains).6 However, if you withdraw more than you’ve paid into the policy, your withdrawals will be taxed.

Cash Value Lost at Policyholder’s Death

When a policyholder dies, the insurance company keeps the account’s cash value. Your beneficiaries will be paid just the death benefit, as the policyholder can only use the cash value while they are alive. However, some life insurance policies allow you to increase the death benefit as you build the cash value.